|

|

Global wealth incubaTors

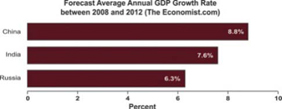

Wealth creation rates in China, India and Russia are surging ahead of the rest of the world. One private bank is forging inroads into these markets. Although Russia’s record growth is primarily due to the booming oil and gas industry, China and India are rapidly becoming production hubs for the world’s information technology and industrial manufacturing sectors. The result is an unprecedented creation of wealth in the hands of industrialists who are taking the risks and leading the way towards record growth and job creation, transforming the economic landscapes of these countries on a daily basis. Annual GDP growth in the 8-10% range in these countries has become standard fare. In 2006, the world average for annual GDP growth was 3.5%. In 2007, China’s GDP growth rate was expected to reach 11.5%. What matters most to investors, however, is the future. The Economist.com predicts that although GDP growth will diminish somewhat in these countries over the next five years, China, India and Russia will continue to lead the way.

With the forecast world average expected to continue to hover between 3-4%, China, India and Russia will double and almost triple the global average. Compare this to the United States where the GDP growth rate

is expected to grow by 1.2% in 2008 and 2.8% in 2009. The GDP in the G7 countries combined is expected to grow at a rate of 3.0% between

2008 and 2012. In 2004, the most recent year for this data, the number of high net worth individuals in the world (net worth of $1 million or more excluding the primary residence) increased by 600,000 to reach 8.3 million individuals. This is the equivalent of 1,640 new millionaires every day. According to the Merrill Lynch World Wealth Report for the same year, the driving forces are clear: ‘The so-called BRIC nations – Brazil, Russia, India and China – continued to emerge as an economic force and create wealth in the process.’ Wealth creation results in an increased need for wealth management services. High net worth individuals require financial services and investment advice. At the end of 2004, there were 8.3 million high net worth individuals with a combined net wealth of over $30 trillion. Investor activity |

One private bank in particular, Millennium Bank, is making a name for itself in worldwide financial circles. Based in the Caribbean enclave of St. Vincent and the Grenadines and owned by United Trust of Switzerland, a long-established Geneva-based trust company, Millennium Bank is forging inroads into China, India and Russia ‘in order to reach investors rather than waiting for investors to reach us’, says managing director Brijesh Chopra. ‘Our approach is proactive. The competition is far too strong to sit and wait for this new wave of investors to come to us.’ Millennium Bank’s five-year plan is to meet as many new investors in as many urban centres within these three countries as possible. ‘We have to work hard, very hard to achieve success. It is that ethic which inspires the confidence of our worldwide clients,’ adds Mr. Chopra.

Emerging giants may end up being an understatement. As the world economic order continues to adjust to the forces of the global economy, China, India and Russia are poised to lead the way towards an unprecedented era in wealth creation that could see the total number of high net worth individuals triple to more than 25 million by 2025. Private banks such as Millennium Bank are positioning themselves for one of the greatest wealth creation booms in history. They are doing it by integrating their business strategies with the realities of the new world. Millennium Bank is a wholly-owned subsidiary of United Trust of Switzerland SA, a private Swiss trust company located in the heart of Geneva’s financial district. United Trust of Switzerland SA has been serving clients from all corners of the globe since 1931. Millennium Bank is the benefactor of Swiss banking experience, Switzerland’s recognised knowledge of privacy, as well as the vast global investment network that United Trust of Switzerland SA has built over the last 77 years. As entrepreneurs discover the riches of success, they discover the crucial importance of managing their wealth. The emergence of China, India and Russia is led by its entrepreneurs who are taking the risks that are generating record growth. These business leaders are pioneering a path that shines as an example for the world to follow. Millennium Bank commends the spirit of entrepreneurship worldwide and hopes that this path also leads to a world of greater peace and democracy. Further information Millennium Bank & Trust |

|